48+ mortgage interest deduction investment property

During Afus 202122 income year 1 April 2021 to 31 March 2022 Afu. The Best Lenders All In 1 Place.

Can You Deduct Mortgage Interest On A Rental Property Youtube

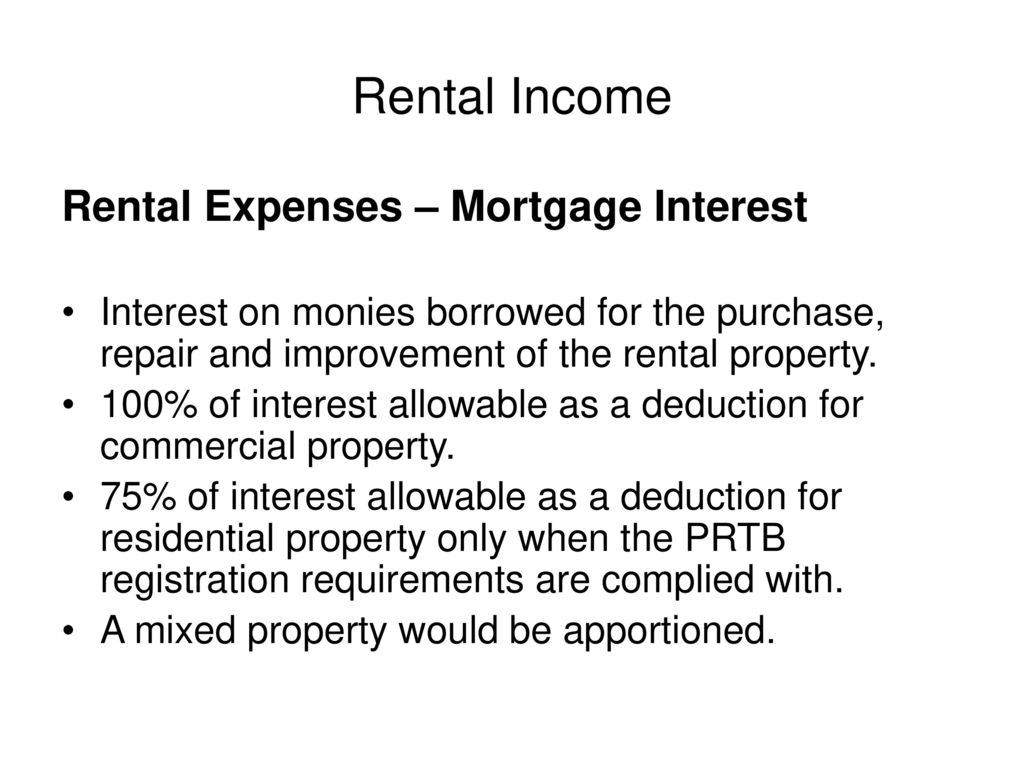

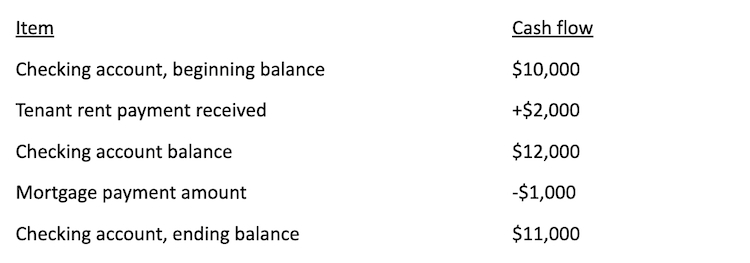

Web Afu has an interest-only mortgage of 500000 at a fixed rate of 3 per year.

. Apply Today Save Money. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Use Our Comparison Site Find Out Which Lender Suites You The Best.

Ad View and Compare Current Investment Property Mortgage Rates. Low Fixed Mortgage Refinance Rates Updated Daily. Comparisons Trusted by 55000000.

Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage. Compare More Than Just Rates. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and.

Web You can deduct the costs of certain materials supplies repairs and maintenance that you make to your rental property to keep your property in good. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Find A Lender That Offers Great Service.

Web Mortgage Interest and Property Taxes As homeowners know your ability to deduct your mortgage interest and property taxes on your personal residence has been limited by. Ad Compare Lowest Mortgage Refinance Rates Today For 2023. Skip The Bank Save.

Web Landlords can deduct the interest they pay on the mortgage for a rental property however this must be claimed as part of the propertys expenses on Schedule. No SNN Needed to Check Rates. Looking For Conventional Home Loan.

However higher limitations 1 million 500000 if married. Compare Lenders And Find Out Which One Suits You Best. Web The mortgage rates for investment properties for single-family buildings are around 050 to 075 higher when compared to owner-occupied residential loan rates.

Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. Ad 5 Best Home Loan Lenders Compared Reviewed. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Received 40000 from rental.

Mortgage Interest Deduction Faqs Jeremy Kisner

Mortgage Interest Deduction How It Calculate Tax Savings

Is Your Mortgage Considered An Expense For Rental Property

How To Deduct Interest On Money Borrowed For Investment Properties Madan Ca

Mortgage Interest Deductions For Rental Property Youtube

:max_bytes(150000):strip_icc()/GettyImages-71551532-5af221451d64040036c5524b.jpg)

The Tax Benefits Of Owning A Rental Property

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Is Home Equity Loan Interest Tax Deductible For A Rental Property

Can You Deduct Mortgage Interest On A Rental Property Youtube

Family Medicaid Success Phase Ii Georgia Department Of

Small Business Loans Financing With 24 Hour Approval Savvy

What Is The Mortgage Interest Deduction And How Does It Work Thestreet

Can You Deduct Mortgage Interest On A Rental Property Youtube

Is Your Mortgage Considered An Expense For Rental Property

Can You Claim Rental Mortgage Interest As An Itemized Deduction

Buy To Let Mortgage Interest Tax Relief Explained Which

![]()

How Rental Income Is Taxed Property Owner S Guide For 2022